Impact of corona virus (COVID-19) on the textile sector 2020-11-12 10:47:35

Impact of corona virus (COVID-19) on the textile sector

By: Dr. Tamer Mostafa Hamouda

Associate Professor, National Research Centre, Textile Research Division.

Intexive Consulting

A virus which started from Wuhan, China, Has caused a great surprise to the whole world, which is considered as the world’s worst experience. All nation has been affected and has faced partial or full lockdown. As an impact of this pandemic, the demand for Textile goods and products was suddenly decreased or almost stopped domestically and internationally. COVID-19 has not spared any industry and Textile industry was one of its victims. The impact of coronavirus (COVID-19) was felt hard across textile, apparel, and fashion industries especially in countries that their export depends on textiles. On the other side, Technical Textile producers have witness a great demand on their product which encourage them to expand its production units. Not only that, but also the unit price has increased by 50 times in some products like meltblown nonwoven, face mask, gloves, and disinfection products.

For instance, in Egypt and according to a report published by American chamber of commerce in Egypt, exports of ready-made garments, which account for the bulk of Egypt’s textile exports, decreased 8% year-on-year in Q1 2020 to USD 372 million.

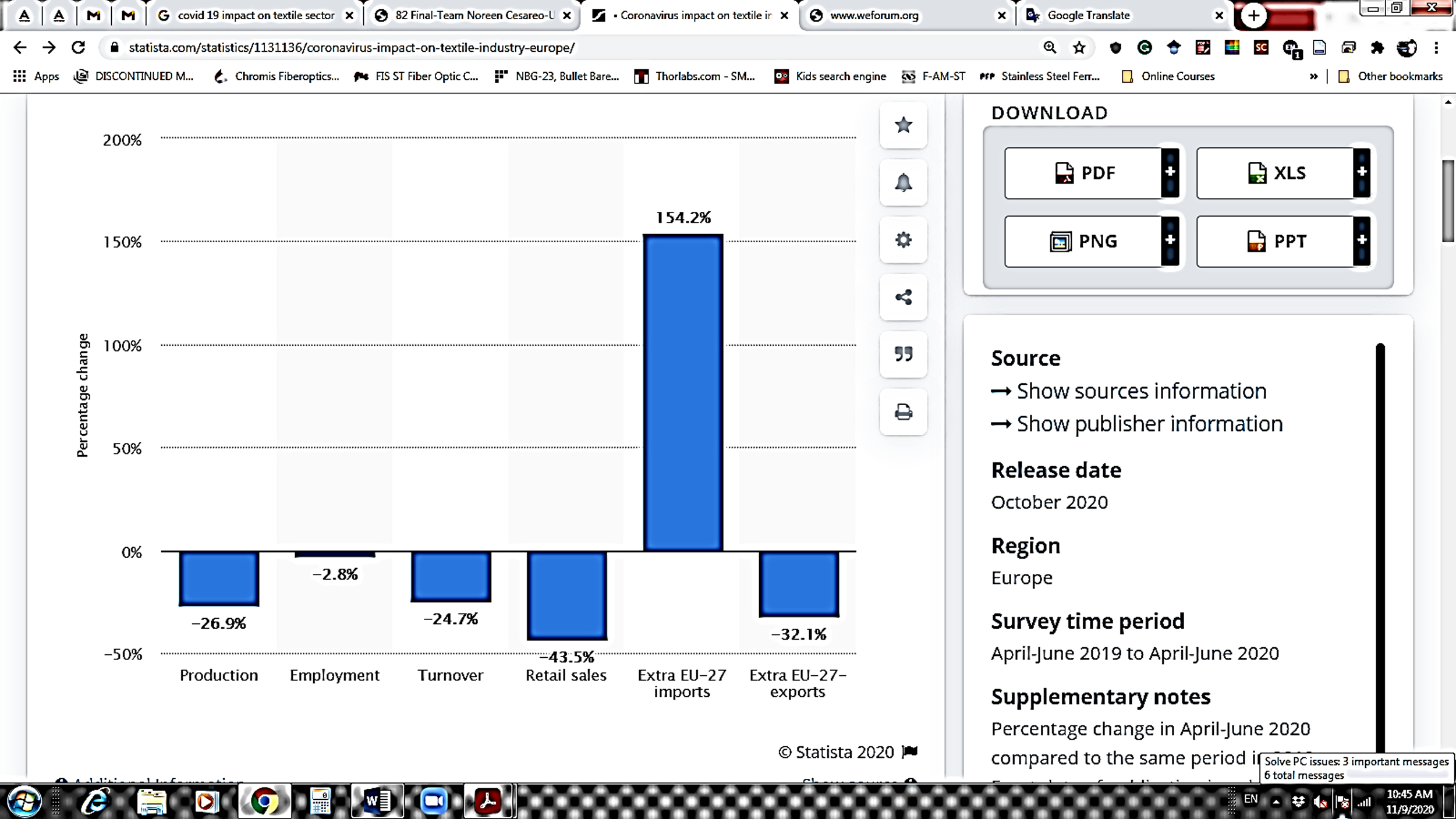

In the textile sector in Europe, compared to the same period in 2019, production fell by 26.9 percent in the period between April-June 2020, when global coronavirus cases reached a peak. In contrast, Extra EU-27 imports of textile products saw a dramatic increase, with 154.2 percent on the same period of the previous. This was likely due to the import of personal protective equipment (PPE) that were needed during the peak of the coronavirus crisis in Europe.

In Turkey and based on Ministry of Trade data, Before the pandemic spread in January 2020, Turkey’s fashion exports had registered a y-o-y increase of 5.8%14 , while the sector enjoyed a 10.1% share in Turkey’s overall exports of $14.8 billion. However, during the pandemic the clothing and textile industry emerged as the worst-hit industrial sector. Textile and Apparel exports began to contract in March. The most severe impact was felt in April 2020, when exports reached only 44 % and 35 % respectively of the previous year´s sales for the same month. Following initial signs of recovery in May, exports have rallied further in June. However, exports in the first six months of this year represent 78% of the previous year’s sales in the case of textiles and 80% in the case of apparel. It remains to be seen whether exports will fully recover by the end of the year. A large proportion of Turkey’s textile and apparel exports are destined for Europe. Nearly 73.4 % of exports go to EU countries, with Germany, Spain and the UK being the main destinations.

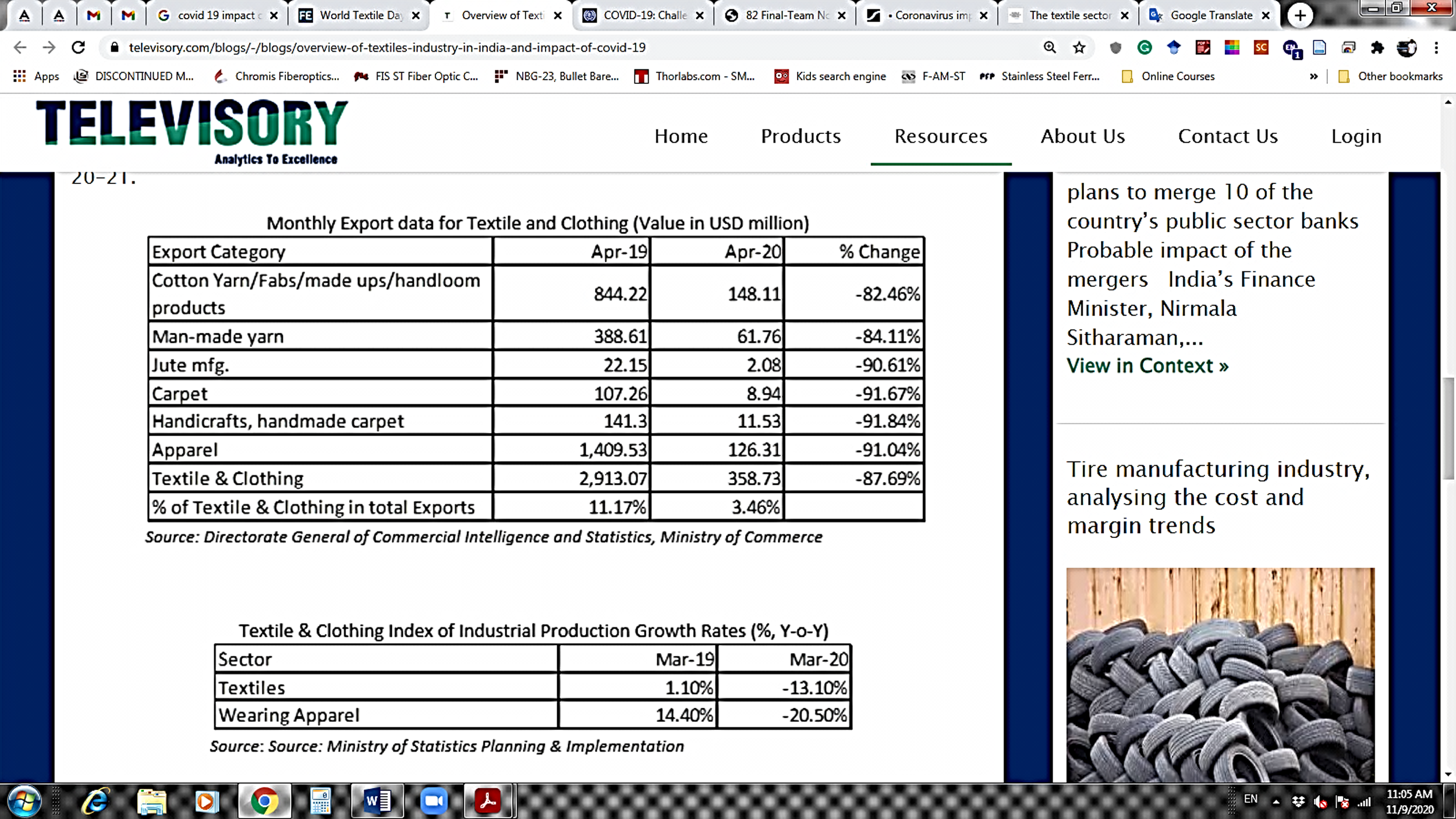

In India, Textile Industry is one of the largest contributors to the country’s exports with around 11.4% share in India’s total export earnings for the fiscal period ended 2018-19 valuing to nearly USD 37.5 billion and growing at a CAGR of 7% since 2004-05. India ranked 2nd in textile export with 6% of global share and stood 5th in apparel export with 4% of global share. The widespread impact of the covid-19 which has left no sectors unturned and is expected to decelerate the growth projection of the textile and apparel industry in India, which was once projected to grow at a CAGR of ~12% to reach USD 220 billion (INR 16,637 billion) by 2025-26(as per the data released by the Ministry of Textiles). Due the outbreak of the pandemic, it is expected that the domestic market is seen shrinking by around 28%-30% to USD 61 billion (INR 4,163 billion) led by the decline in the sales mostly in the Q1 for the current financial year ending 20-21.

COVID-19 impact on global nonwoven fabrics market

The nonwoven fabrics market is expected to witness significant growth during to the COVID-19. The nonwoven manufacturers around the globe are expanding their production capacity and investing in machinery to manufacture healthcare essentials) in response to the COVID-19 pandemic. The increase in the number of cases worldwide and the growing need for healthcare workers are expected to boost the demand for disposable hospital supplies and nonwoven materials during the forecast period.

Lydall invested in the new fine fiber melt-blown production line to meet rising global demand for face masks. This new production line will enable Lydall to produce high-quality fine fiber melt blown filtration media for N95, surgical, and medical face masks and significantly increase their supply and help alleviate the shortage of melt blown materials, both in the US and internationally. Berry Global has announced an expansion of its Meltex melt-blown capacity, with the addition of an asset to support the growing demand for face masks during COVID-19. Ahlstrom-Munksjo has increased its nonwoven production across its entire protective materials portfolio, in response to COVID-19.

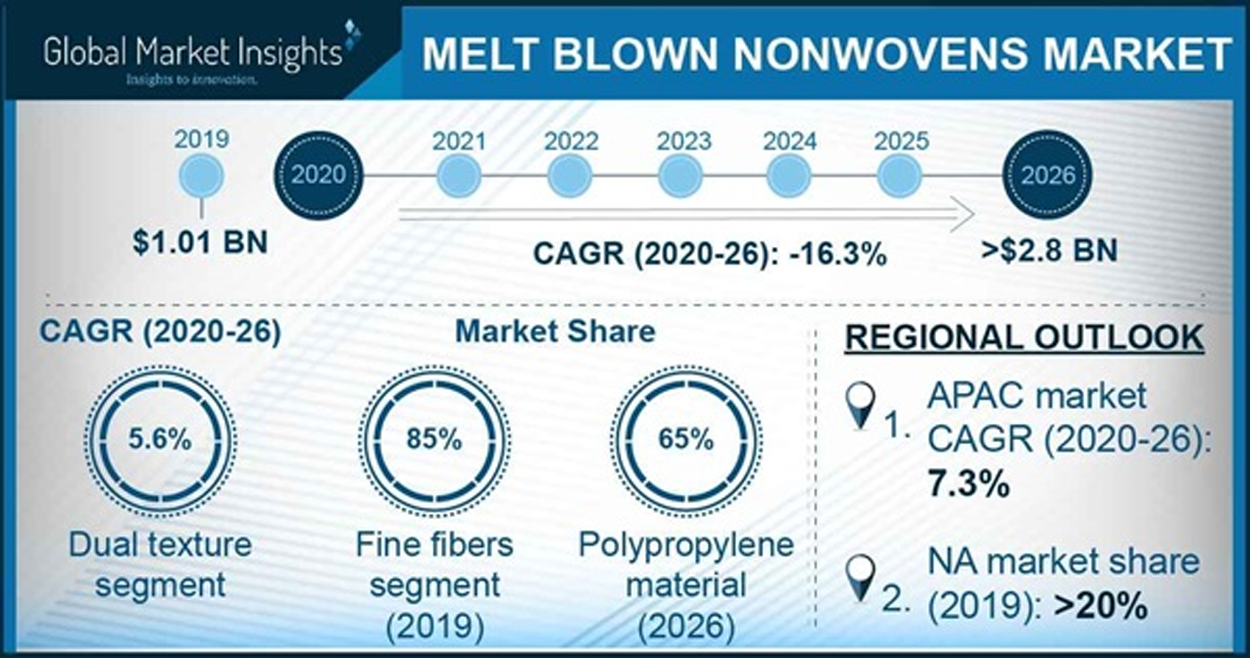

The Covid-19 pandemic increased the demand for masks such as surgical masks, N95 or professional-grade medical masks, and personal protective equipment (PPE) kits. As most of these products use melt blown nonwovens fabric as a filtering layer, the demand for melt blown fabrics has increased exponentially. Melt-blown nonwovens market size was USD 1.01 billion in 2019 and will grow at a CAGR of -16.3% from 2020 to 2026.

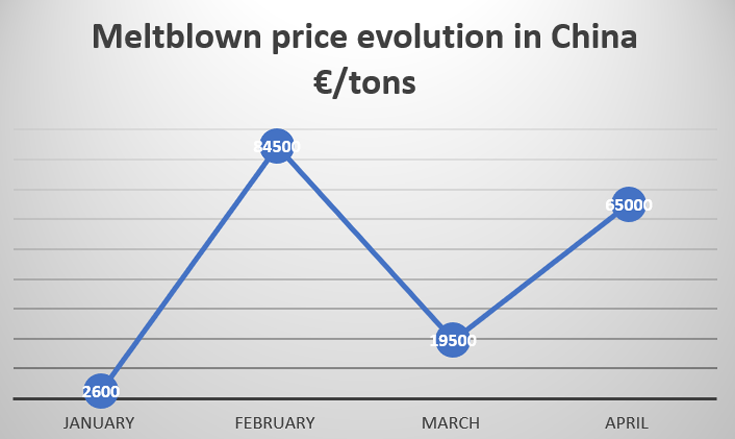

with the outbreak of COVID-19, the market price of meltblown fabrics in China seems to have taken the "roller coaster".

The original price before outbreak was approx. 2600 €/ton. With the outbreak in Wuhan this price increased to 84500 €/ton and go down after a few weeks to 19500 €/ton. With the outbreak in Europe, and later in the US, this price as rebounded from 19500 €/ton to 65000 €/ton - 25 times higher than the original price. And the difficulties to find meltblown for face mask production, are bigger and bigger, with high requirements at order. Some require 'cash lock', other require 50 tons order, with first pay of 20% deposit.

According to the big data disclosed by ALIBABA International, the demand for medical masks on the website increased by 13769% from February to March. The data shows that the meltblown cloth is the core material of the mask. However, since there are not many large manufacturers that can produce meltblown fabrics in China, the industry as a whole is small and scattered. China Petrochemical Corp, the nation's largest oil refiner started two production lines to manufacture 4 metric tons of fabric that can be made into 1.2 million N95 respirators or six tons of fabric for 6 million surgical masks every day, according to the company, also known as Sinopec. China Petrochemical Corp, the nation's largest oil refiner, plans to start production at eight more meltblown nonwoven fabric production lines in Jiangsu province by the middle of next month after commissioning two new units in Beijing. Upon completion, the 10 production lines will be able to produce fabric for 3.6 million N95 respirators or 18 million surgical masks every day.

So, I believe that the impact of COVID-19 on the textile industry will remain for sometimes especially for the traditional textile. The recovery for its impact will take a while as many factories have shutdown and many labors have been laid off. But, there are an opportunities for the textile investors in Egypt to transfer to technical fabric for Personal Protection Equipment’s (PPEs) as an example, or for any other application that depends on technical fabrics. I also believe that the people will pay more attention to their safety whether they work as first responder or they are dealing with others. This attention will be transferred into big demands for PPE. Also this pandemic has increased people’s attention to the quality of the PPE that they use and how these PPE meets the required standards, which I consider a big positive impact of the pandemic.

Source:

https://www.statista.com/statistics/1133020/coronavirus-impact-on-textile-orders-europe/

https://www.gminsights.com/industry-analysis/melt-blown-nonwovens-market

https://www.e-nispe.com/actuality/meltblown-price-evolution-in-china-from-january-to-april-2020